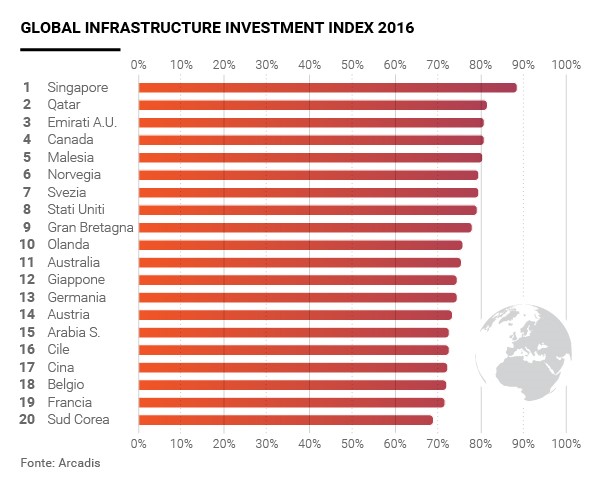

Strong growth potential, a secure environment favorable to business, a solid legislative and regulatory system and a stable political environment. These are the factors that make a country attractive for investors looking to finance infrastructure projects. They are used by Arcadis, a Dutch design and consultancy firm, to select the 10 most attractive countries where to invest, including Singapore, Qatar, the United Arab Emirates, Canada, Malaysia, Norway, Sweden, the United States, the United Kingdom and the Netherlands. These countries head the third Global Infrastructure Investment Index 2016 published by Arcadis every two years.

The topic of the report – entitled “Bridging the Investment Gap” – that accompanies this year’s rankings is the investment gap in infrastructure. It examines the factors required to help countries in need of funding follow the example of those that top the rankings and attract the greatest amount of interest. The report looks at data from the World Economic Forum, which estimates that an extra $1 trillion should be invested every year to close the gap in infrastructure. This would mean investing a combined total of $14 trillion until 2030. It is an amount that could result in more efficient transport, reduced traffic congestion in large urban centres, better water systems, clean energy and modern communications. Responding to these requirements, the report says, is something to be done by public institutions with the help of private investors.

But not all countries offer the same guarantees, which explains why public and private investors manage to work together only in some markets, essentially the most modern and transparent ones. In its composition of the rankings, the Global Infrastructure Index takes into account long-term investments linked to projects that last at least five years. It also factors in the performance of countries based on 24 indicators: from the ease of doing business to the state of the economy; from currency fluctuations to debt ratings; from exports to the risk of terrorist acts. Among the top 10 countries, the one that has made the biggest improvement has been the United States, which has risen in ranking from 11th to 8th in four years. This rise is based on an improving economy, a low level of risk and a solid financial sector. The country also has a market that offers many opportunities for investors. It is only in the transport sector where Arcadis sees an investment gap – one whose value is calculated at $86.5 billion.

Like the United States, countries in Europe remain among the most stable and mature markets that attract investment in infrastructure. In fact, eight of the top 20 rankings are held by countries from the region. One reason is the widespread use of public-private partnerships (PPPs). This is occurring especially in northern European countries, such as the United Kingdom, France, Germany and the Netherlands. Another factor is the Juncker Plan, a project launched by Jean-Claude Juncker, head of the European Commission, to give the region’s economy a boost with €315 billion worth of investments in infrastructure.

The developments witnessed in the Middle East are also significant. Their propensity towards investing in infrastructure is well known, but some countries like Qatar or Dubai of the United Arab Emirates are undertaking important changes. In order to lighten the burden of grand infrastructure projects on the public sector, they are passing laws to make it more appealing for private investors to participate.

Another country of great interest is Australia. Although it dropped to 11th place, the country is showing signs of recovery with Sydney and Melbourne becoming attractive to infrastructure investment. Melbourne has approved a project to privatize the commercial port and use the earnings to invest in the construction of a subway. In Sydney, the $10 billion Australian dollars earned from the privatisation of the electricity grid is to be invested in roads and railways during the next eight years.

But it is Singapore that remains at the top of every ranking, according to Arcadis. When analyzing all the components that make up the index, Singapore represents the most attractive market for investors. And this is due to the fact that the government is opening the door to private investors. There are many opportunities available as the government views the sector as an engine of growth and pursues a strategy to invest $20 billion or the equivalent of 5% of its gross domestic product (GDP) in infrastructure. By 2020, the city state plans to invest 6% of GDP or $30 billion, making transport a priority with the construction of a fifth terminal at the Changi Airport.

With the government having adopted a series of long-term initiatives in recent years, Malaysia has also shown a keen interest in investing in infrastructure, which explains how it ranks seventh in the index. It is yet another example of the dynamism of a region that offers investors an option in addition to the mature markets of the United States and Europe.