If there are two numbers that illustrate the extent of China’s participation in infrastructure investment in the world, they would be the following: 3,485 projects for a total value of $273.6 billion.

The numbers, which refer to the last 15 years of the government’s involvement in projects outside the country, come from “Chinese Infrastructure Projects and the Diffusion of Economic Activity in Developing Countries”, a study published a few weeks ago by the U.S. research centre AidData. It is a complex study, which examines projects in 138 countries between 2000 and 2014 to arrive at comprehensive numbers such as the two mentioned above. Nearly half, or 43%, of the projects concern the construction of roads, railways, ports, airports, electrical systems and dams. Another 42% are social infrastructure such as hospitals, schools, and so on. The remainder are projects supporting tourism and agriculture.

Overall, what emerges is a picture of China’s extensive reach, especially in developing countries – part of a strategy some 50 years old.

The first stone

China began investing in infrastructure beyond its borders in 1967 in Tanzania. It took over from a group of countries (United States, United Kingdom, Japan, Canada, France, West Germany and the Soviet Union) to build the Tazara Railway, a 1,860-kilometer-long railway connecting the copper mines of Zambia with the port of Dar es Salaam. The Chinese government allocated $415 million (equal to $3 billion today), in what was the country’s largest foreign investment at the time. It has since come to be seen as a milestone for Chinese investment in infrastructure, a prime example of the country’s international activism.

Chinese traction in the world of infrastructure

China’s presence in foreign markets has steadily grown to rank the country as a world leader in construction and modern transport infrastructure.

In Africa, it has financed the construction of the Addis Ababa-Djibouti railway for $3 billion, as well as the railway that connects Kenya’s Nairobi with Mombasa for $4 billion. In Asia, it has allocated $7 billion to build a high-speed line connecting the Chinese province of Yunnan with the capital of Laos, Vientiane. Another $2 billion has been invested in the highway that links Karachi to Kahore in Pakistan. In Latin America, China paid for the modernisation of 1,500 kilometers of Argentine motorways worth $ 2 billion, as well as road and rail development projects in Venezuela, Jamaica, Ecuador and Bolivia. The Chinese government has also invested $2 billion for the electrification of a 926-kilometer-long railway line Iran’s Mashhad with the capital, Tehran.

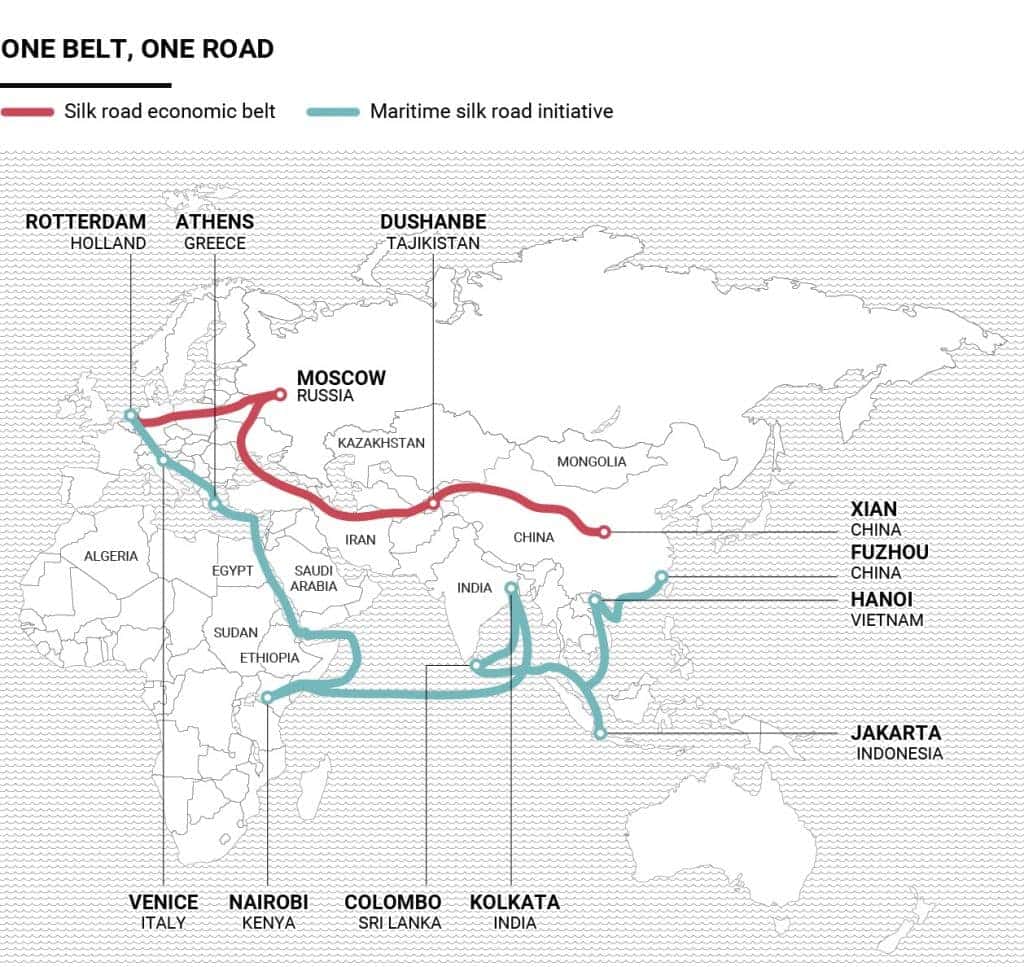

These massive projects are but a few of those launched in recent years with financial support from Beijing, united by an idea that led to the 2013 launch of “One Belt, One Road” by President Xi Jinping. Also known as the Belt and Road Initiative, it aims to build a modern network linking Asia and Europe and give life to a new version of the ancient Silk Road to accelerate the exchange of people and goods in an area where 70% of the world’s population lives and produces 55 % of global GDP.

“One Belt, One Road” is the cornerstone of China’s infrastructure policy, and is in turn part of a global vision in which companies and government work together.

The Asian bank looks at the world

Another step in boosting its global leadership in infrastructure investments was to set up the Asian Investment Infrastructure Bank (AIIB). Launched in January 2016, the bank is financing 32 projects and, in 2017, allocated $4.2 billion. Among the projects funded last year is the first loan granted outside Asia: to the Egyptian government for the construction of solar power plants.

«The AIIB’ s board has agreed that 15% of the bank’s capital can be invested in countries outside Asia», said its president Jin Liqun to financial newswire Caixin last week. «And that can be adjusted in the future. At present, Asian countries hold 75% of the AIIB shares, and non-Asian countries hold 25%».

Although the bank’s shareholder base is spread among the 87 member states, China remains the leading shareholder. With a stake of over 30%, it is able to set the investment agenda of a bank born to compete with the World Bank headquartered in Washington, D.C.